Timing Interest Rates

- Henry Holt

- Sep 11, 2025

- 4 min read

Updated: Sep 13, 2025

This discussion is relevant to refinances, when there is not a looming loan maturity.

🔍 Should I postpone closing my loan, because I believe interest rates will drop?

This is a personal decision. You could be right in your rate prediction. But you could also be wrong. Here are my thoughts:

💡 The Benefits of Closing as Soon as You Can:

“A bird in the hand, is worth two in the bush.”

Loan sizing risk: If you want to wait to max out loan proceeds, this could be dangerous game. What if interest rates only go up from here? Your loan amount could get noticeably smaller. We know what your loan sizes to today. If that works, don’t gamble on rate movements.

Lending Market risk: Never know when there is going to be another COVID style event, where lenders will pause or step back for whatever reason. It’s a low chance, but still a chance. If the markets are functioning now, jump on it.

Execution Risk: No lender can guarantee closing at application/signed LOI. These agreements are subject to a number of things: 3rd party reports, approval by loan committee, etc. Let's say you have a 6-month window to close. If you start the loan approval process right now with a lender, and they back out due to some reason or retrade their loan terms, there's still time to jump to another lender. If you wait until 2 months before your loan maturity date, you don't have time to jump to another lender.

💡 The Benefits of Trying to Time Interest Rates:

Rates could drop:

This would save you money, if you are wanting to lock into a fixed rate loan.

This could increase your loan proceeds.

🔍 What projection tools are available for me to time interest rates?

This question is especially relevant given the time that I am writing this in late 2025.

Short-Term / Floating Rates

These are rates based off of Prime or SOFR:

Federal Reserve News: The Fed has been talking about possibly lowering the Federal Funds Rate this year. This will lower short-term rates. If you have a loan based on Prime or SOFR, your interest rate should drop in pretty close lockstep with the Fed Funds Rate.

Economic News: The Fed makes its decisions based on a number of factors, but the 2 primary factors it has historically focused on are inflation and unemployment. If inflation is getting higher or unemployment is staying constant or dropping, you can typically expect a rise in the Fed Funds Rate.

FedWatch Tool: CME has a FedWatch Tool that estimates the probability of a rate reduction based on interest rate traders in the market. See snip below of the September 17, 2025 projection. Traders are projecting that the Fed will lower the Fed Funds Rate by 25bps. Not shown in the snip below, but they are also projecting another 25bps rate reduction in October, and another in December. However, a reduction in short-term rates does mean long-term rates will drop.

Long-Term Rates

Long term rates impact fixed rates debt options.

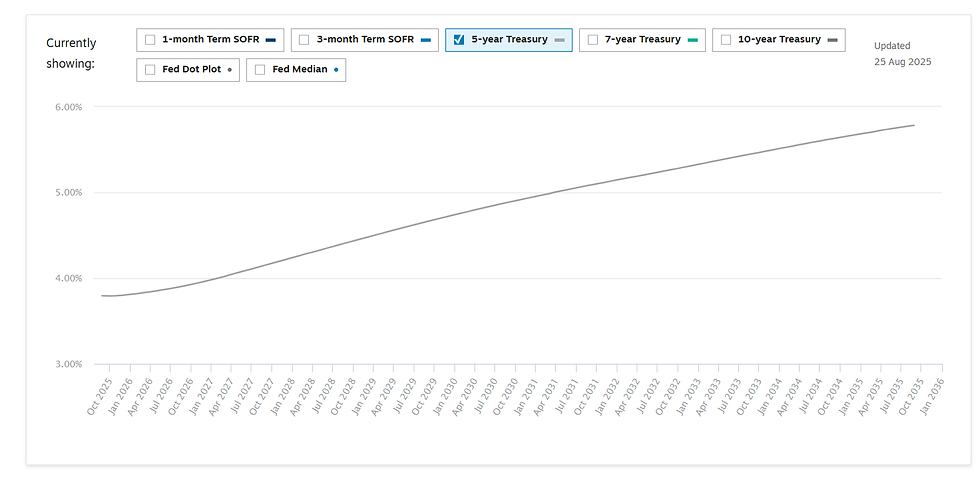

Chatham Financial: Chatham Financial has a similar tool as CME FedWatch. Except they have market predictions of long-term rates, and it's not shown in a % probability format, but an average projection. This is the 5-year UST projection over the next 10 years.

📌 Important Note:

Notice how the Federal Funds Rate is projected to go down (this impacts prime and SOFR based loans), but the market is predicting long-term rates (impacting fixed rates) will actually go up!

This makes a major point: Just because the Fed is going to lower the Fed Funds Rate doesn't mean long-term rates will go down. They could go opposite of each other.

🔍 Should I trust any of these tools?

My personal view is "yes a little bit", but "mostly no". In my view, the market has been a terrible predictor of where rates are going to go, especially over the last years.

If you made any major decisions based on where the market thought rates were going to go over the last 5 years, I think there's a good chance your decision was a loss.

The Hairy Chart, put together by Chatham Financial, shows how good the market has been at predicting interest rates. The solid blue line shows where interest rates actually went. The gray lines show where the market predicted rates to go at the time.

📢 Final Conclusions:

A bird in the hand is worth two in the bush. If you can close now and it makes sense, don’t gamble on which way rates will go. They could go way up, and you could be filing chapter 11 because of this. We just saw a meteoric rise in rates just like this in March 2022. And there’s a lot of investors who are being foreclosed on because of this.

Nobody knows which way rates are going to go. If they did, they’d be trillionaires.